When selling internationally, catering to the local customer is very important. The global reach and instant result of credit and debit card payments results in a false sense of security. Don’t get caught unaware of the risks of these very popular payment methods.

The Internet Retailer cites a Javelin Strategy & Research report that 71% of online purchases in 2009 were made directly with credit and debit cards, “and the 16% that Javelin says went through alternative systems like PayPal, Google Checkout and Amazon Payments mostly end up charged to credit and debit cards.”

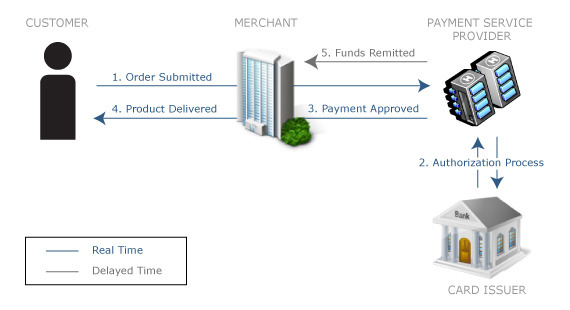

Credit-card based payment methods, such as Visa, MasterCard, American Express, JCB, Carte Bleue and Maestro, usually result in instantaneous acknowledgment of payment acceptance. The customer enters his credit or debit card number in an online Web form or software application, submits his personal info and and waits less than 10 seconds for a response, which is usually positive. Obviously, from an instant gratification perspective, this is the best outcome for both the customer and the seller. The following graphic illustrates this process.

When considering the all-in financial costs of credit and debit cards, effective rates of 3%-6% are the normal in the online, card-not-present world. These rates vary based upon card type (Visa/MC, Amex, JCB, etc), average transaction volume, total transaction volume, return/refund rate and a merchant’s transaction history. If that’s all that there was to it, credit and debit cards would be a cost effective way of accepting global, online payments.

Unfortunately, there are risks associated with credit and debit card based payment methods and they appear after the transaction is approved.

First of all, remittance of the collected money is delayed anywhere from 2-28 days before arriving in the merchant’s bank account. Although payment service providers receive the transaction’s funds within a day or two, remittance to the merchant is delayed and can cause cash flow problems for companies with small cash reserves. American Express notoriously has one of the longest delays between payment collection and remittance to the merchant.

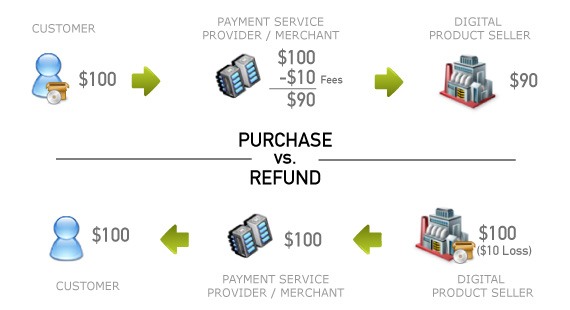

Secondly, companies often offer liberal return policies designed to ease customer concerns during the purchase process. The negative effect is that anywhere from 0.5% to 5% of orders result in a refund. Payment processors retain their fees even though companies issue a full refund to the customer. On top of the effort of resolving the customer’s issue, the merchant also loses the payment processor’s fee. The graphic below illustrates both sides of the transaction.

Merchant’s also need to store the card numbers in order to provide a refund of the purchase. By storing credit card numbers, merchants become targets for hackers attempting to steal credit card numbers, which results in a potential public relations nightmare. Furthermore, merchants come under the scrutiny of the Payment Card Industry (PCI) standards for handling credit card numbers. Improper practices can result in higher fees or even revocation of a merchant’s ability to accept credit cards!

Thirdly, accepting credit cards online is an invitation to frauders, who attempt to use stolen card numbers to receive digital products. Due to the instantaneous delivery of digital products, ecommerce platforms that sell digital products must be equipped with tools to identify and stop potentially fraudulent order attempts.

For a few hundred dollars, frauders acquire batches of stolen credit card numbers online. They use these card numbers as frequently and as soon as possible because stolen card numbers are typically identified and disabled within a few days. If you’ve ever had your credit card number compromised, you’ve probably seen three or more transactions within two days for this very reason.

Additionally these credit card purchases can be charged back to the merchant, resulting in additional chargeback costs of up to $30 for each event. Once a chargeback rate (the total chargebacks divided by total orders) exceeds approximately 1%, you may lose the ability to process credit cards, which obviously impacts your business greatly.

One of the benefits of out-sourced e-commerce platform companies is that they see transactions from many different merchants and information about fraudulent attempts are shared between all companies utilizing that platform company. This results in a broader and deeper understanding and ability to manage risk.

Keystone

Credit and debit cards are ideal payment methods for customers buying digital products, but be aware of the risks of accepting cards are before jeopardizing your online business.

Have you had any horror stories with accepting credit or debit cards? What have you learned about accepting cards that surprised you?