“Stop using Excel, finance chiefs tell staffs,” was the provocative Wall Street Journal headline that made me stop my incessant scrolling. Did I miss something? Was Microsoft Excel on its way out?

It turns out, no spreadsheets were harmed in the making of that think piece. Instead, the article went on to cite the multiple data visualization tools that Fortune 500 companies were buying or building to cut down on time spent exporting data and making graphs. Ultimately, the “Export to Excel” button isn’t going away, and we all have to find a way to make data work for us and not the other way around.

Affiliate programs are no stranger to the spreadsheets-for-the-sake-of-spreadsheets problem. Affiliate management is a data-driven practice, therefore we spend a lot of time looking at numbers and trying to figure out what to do with them. I am not one to spend more time in a data table than I need to, and with these three geeky habits, I’ll illustrate how to tell a story with your affiliate data in a way that will grow your program and convey the efficacy of your work to clients, bosses, executives, and anyone else who needs convincing.

Focus on Your Emerging Affiliates

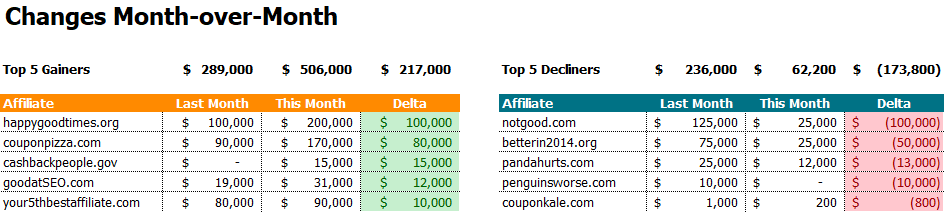

Can you name your top five affiliates off the top of your head right now? Chances are, you didn’t need to consult a spreadsheet for that. If you know them by heart, you probably spend enough time talking about them. What about the movers and shakers in your program, can you name those? That question conjures something in your mind that probably looks like this:

Click to enlarge:

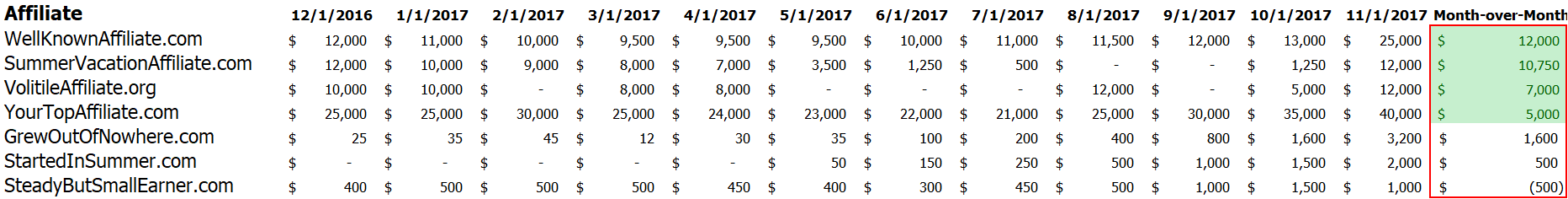

Barring a few fluctuations, nothing moves within those lists. Mostly it’s money moving from one bucket to another. So how do you find a new affiliate that truly shows potential in your program? You could look at longer-term performance, perhaps spanning the last twelve months:

Click to enlarge:

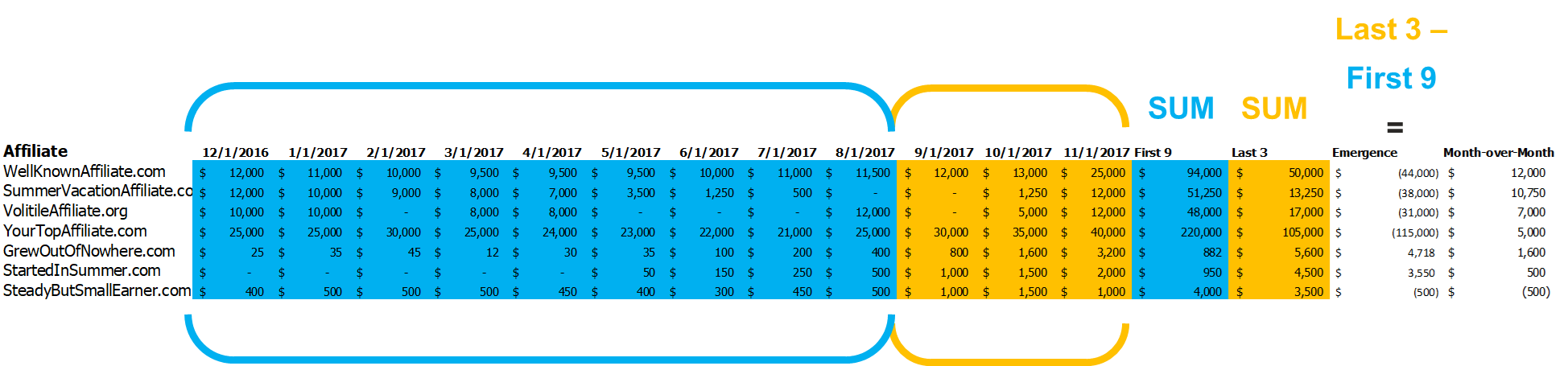

However the further back this data goes, I’m still not doing much to find the overall performance pattern if I use that month-over-month column at the end. I need to think differently to find real indicators of change. Enter “the emerging affiliate,” indicated by a few extra equations that look for risers in the program.

Click to enlarge:

Following the prompts above, I simply subtracted the sum of the first nine months in my table from the sum of the previous three months. Most of the results will be negative as expected when you subtract a larger period from a smaller one. This makes the positive results stand out even more. The top emerging affiliates are demonstrating increased activity over the last three months that surpasses their efforts in the first nine. In other words, whatever they’ve been working on is finally making a difference. That difference is often lost in the normal monthly gainers and decliners because their monthly changes are slighter than your more well-established players.

What do you do now with this knowledge? Start a relationship of course. In the example above, I would be quick to reach out to StartedInSummer.com and GrewOutOfNowhere.com to begin a relationship if I haven’t already. The increased attention from the brand or program manager can make a big difference. Offer your emerging affiliates extra incentives, early access to promotions, or random perks. You’ll be surprised how affiliates that you’ve never heard of will become key components of your program.

Be Better Than Your Own Tracking

As an affiliate manager, you’re often stuck between a rock and a hard place when your tracking goes down. You want to keep this affiliate happy and pay them for legitimate traffic, but you have no way of knowing for sure what they’ve earned. So you could venture a quick guess (not recommended) or you can impress your clients with your great estimation skills.

Download the free ebook: Aligning Your Subscription Business With APIs

Start by taking what you know. In many cases of downtracking, you won’t lose clicks so it’s often a convenient way to orient this estimation based on the real traffic the affiliate brought in. Along with actual clicks from the downtracked period, you can also look at historical revenue and orders to create a baseline for the kind of performance this affiliate normally does. As a rule, the chosen time period shouldn’t be during an abnormal time of the year like Cyber Week or the winter holidays. From this data you are able to construct key performance indicators (KPIs). This is what I call a “make-good sheet.”

Using a make-good sheet, we can accurately estimate commission based off of past patterns and real traffic. That should please the affiliate without dipping into your client’s pocketbook armed only with a guess and a prayer.

Use Smart KPIs

Top-line revenue from an affiliate program isn’t going to impress everyone. Even the best affiliate programs are only going to bring in a slice of the pie – 10 percent of overall revenue if you’re lucky. So how do you grab the attention of your client’s c-suite executives or even your boss? Presenting long-term KPIs are the best way to get your affiliate program the respect it deserves.

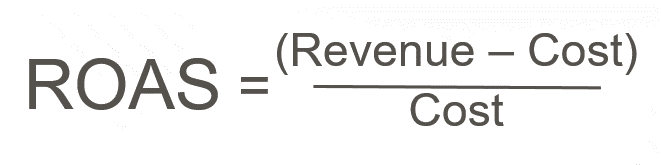

My primary attention-grabbing stat is return on ad spend (ROAS).

Calculating ROAS broadcasts the value of an affiliate program front and center. It also produces an easy-to-understand monetary amount rather than a hard-to-define percentage. Reporting $0.00 ROAS implies you broke even. In other words, it’s as if your client gave you $100 to run the program and you returned the $100. Not bad, but not good either. You want to aim the rest of your affiliate efforts in relation to increasing those returns. Did you turn your client’s $10,000 monthly spend into $20,000 in revenue? Great! You doubled their money at $1.00 ROAS. Is it below $0.00 or close to it? Make adjustments.

What if your ROAS is $0.00 for a few months? Affiliate managers know the summer months can be slow for just about any brand. You must be prepared to explain low returns. If times are slow, shift the focus to long-term value. In the realm of digital goods, this is often easy to illustrate with periodic renewals. If the affiliate program is tasked with user acquisition and you didn’t acquire very many users this month, focus on customer lifetime value (CLV).

If you have a reliable way to show that user acquisitions from affiliate referrals keep coming back to your brand, illustrate that fact. Most often the first purchase happened at a discount. If the digital product is set to renew at full price next year or next month, that’s a revenue stream with a much greater margin than the supposed $0.00 ROAS last period. To top that off, you’re no longer paying affiliate commissions from that customer’s renewals – unless you have a recurring arrangement. So even months with small amounts of new acquisition will pay off during the lifetime of the customer when they’ve shifted from “acquire” to “retain” mode. ROAS and CLV can be your one-two punch for telling the data story of your affiliate program

Keystone

Affiliate program management is a long game. There’s always one more affiliate to email, one more link to send, and of course one more report to create. All your time doesn’t have to be sunk doing that last part. If it seems like you’re making spreadsheets for spreadsheet’s sake, than it’s time to start looking at meaningful data that inspires you to take action.

Grow your program and find the next big affiliate more quickly by looking for emerging affiliates. Be better than your tracking platform by implementing a make-good sheet to easily calculate missed commissions. Prepare your clients for the long affiliate game by using smart KPIs like ROAS and CLV. Those three habits will solidify you as an affiliate geek and show your value to any client or boss you present to.

Nick Oswald is an Affiliate Marketing Manager for cleverbridge. Follow him on Twitter here.