In July 2003, the European Union (EU) began charging Value Added Tax (VAT) on digital transactions that occur within the European Union (See EU Directive 2002/38/EC, May 7, 2002). To European businesses and consumers, the rules for the past decade have been fairly straightforward. However, to companies outside of the EU, VAT collection is a tricky process that causes confusion. Now that the rules are changing again, software manufacturers everywhere need help understanding how these changes impact their business.

2003 VAT Rules

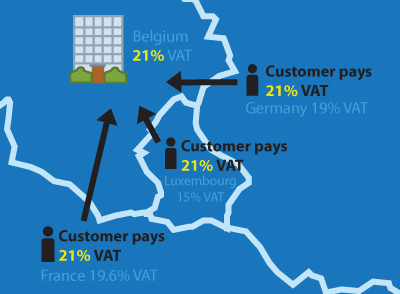

The interesting thing about the 2003 EU VAT directive is that it made calculating VAT rates a source-based system. A source-based system means a VAT rate is determined by the seller’s location. For example, if a business is headquartered in Paris, all their online store transactions with European consumers would include France’s 19.6 percent VAT rate in the price.

While these 2003 regulations simplified VAT calculations for online merchants selling in the EU, they created a loophole for businesses looking to charge the lowest VAT rate. Some companies set up shop in a country with a lower VAT rate to allow the legal transaction to occur in that country. For a company in Luxembourg the VAT rate is 14 percent, thus lowering the cost of a digital product when compared to countries with higher VAT rates, like Hungary or Denmark.

2015 VAT Rules

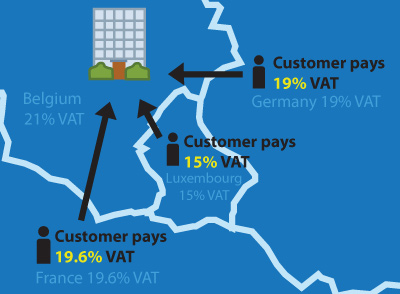

To combat companies setting up dummy corporations for tax sheltering purposes, the EU created new rules that changed VAT assessment to a destination-based tax structure. Starting in January 2015, VAT rates will be based on where the customer resides, not on where the legal entity selling the product is located. This change eliminates corporate tax gymnastics while likely providing EU governments with higher revenue.

So how does this change impact your online store? We have identified several pricing issues we believe will affect your online store’s performance.

Pricing Challenges

When a European customer sees a price on a product page, they assume they are looking at the gross price with taxes included. This contrasts with US consumers who assume the price on a product page is the net price and that taxes will be added on to the price later.

With the 2003 regulations, as long as you presented gross prices to EU consumers, the net price in your cart was static because you were only assessing VAT according to a single rate. The 2015 VAT rules make pricing your product more complicated. There is now an inherent conflict between making things simpler for the business or the consumer.

If you want to make things easier for the consumer, the solution is to configure every single cart to always display a single VAT inclusive price to European shoppers, say 22,95€. This price is displayed on the product page, when the customer enters the shopping cart and after the customer fills out all their billing information.

So, if you’re selling to a German customer, they are paying 22,95€ and when you sell to an Danish customer, they are also paying 22,95€. The difference is in how much actual income you are collecting and how much VAT you are collecting.

With the German customer you are collecting 19,29€ in revenue and 3,66€ in VAT, and with the Danish customer you are collecting 18,36€ in revenue and 4,59€ in VAT. You can see why this could be problematic for merchants trying to maximize profit.

The alternative approach is an abrasive customer journey that create ugly price displays, but maximizes merchant revenues. It means that you as a seller are looking to generate the exact same net revenue on every single transaction. With this approach, different consumers from different countries are paying different gross prices in your shopping cart.

For example, a merchant wants to generate 20€ of net income on every transaction. When a German consumer buys from this merchant, they will end up paying 19 percent VAT and a gross price of 23,80€. When a Danish consumer buys the exact same product, they will end up paying a 25 percent VAT and a gross price of 25,00€.

Every business must make the decision regarding which direction they want to take. The choice falls into a decision of whether to make business operations easier for the merchant or make the checkout process easier for the consumer.

Keystone

Make sure your ecommerce partner is keeping your business compliant in Europe. While most of the complications from VAT rules in Europe will be handled through your ecommerce partner, you, as a merchant have to begin rethinking how you display prices to European visitors.

Please note: This blog post contains no actual legal advice. This is our interpretation of the impact of the 2015 VAT regulations. However, you should still contact your tax adviser for any questions you have about the impact of new VAT rules on your business.