As we make way for a new year in 2013, we predict that software companies will be influenced by important trends in the B2B space, the disruption of traditional media, the app store model and offline payments.

B2B Shopping Mirrors B2C Shopping.

According to Forrester Research, the transactional volume of B2B ecommerce is currently more than twice the size of B2C ecommerce. For B2B software companies this is an opportunity to improve the manner in which they communicate to prospects and capture sales.

B2B companies must begin providing a B2C-like online shopping experience for their buyers. That means looking at business customers in the same way retailers look at consumers. After all, every buyer of enterprise software is also an individual who buys retail online, so they are used to a certain type of online shopping experience. The experience of shopping for one’s company, therefore, will increasingly mirror an individual’s experience of shopping for themeself.

Part of the solution is understanding the channel conflict between direct sales and ecommerce. B2B companies are learning to transition from sales people taking orders on the phone to an ecommerce site which is cost effective and provides a better customer experience. Businesses must be able to offer immediate support at all stages of the buy cycle, including price transparency and instant price comparison.

It also means offering convenient payment options. This is not limited to purchase orders, checks and credit cards, but includes providing mobile payment options as well.

In 2013, vendors of business software must take the time to see if they are offering their buyers the type of experience they have come to expect from shopping online.

Traditional Media Continues To Evaporate Into The Cloud.

Book, newspaper, magazine, radio, film and television publishers are facing a dilemma. With a decline in traditional subscribers and ad revenue, will they continue to hemorrhage money or should they discontinue traditional formats in lieu of digital ones supported by ecommerce subscriptions and usage-based billing?

The evidence for pursuing the latter mode is compelling.

An article by AppAdvice states, “The Association of American Publishers (the industry’s preeminent trade organization) revealed that e-book sales had in fact tripled year-over-year, outselling the print variant in every major consumer division.”

Additionally, thanks to companies like FlippingBook, professionals, scholars and hobbyists alike have the ability to design and publish engaging, interactive content in a variety of digital formats. These capabilities allow self-publishers to generate revenue outside of the traditional writer-publisher relationship, presenting book-publishers with another obstacle to overcome.

Companies that specialize in printing and marketing communications will also see disruptions by digital competitors. Paper-less Post offers digital greeting cards and is a good example of the type of company that will affect traditional off-line competitors like Hallmark and even the postal service.

This situation hasn’t passed up the film distribution industry either. Redbox, who has replaced Blockbuster (who?) as the local vendor of rented DVDs, is jumping on the digital bandwagon, hoping to grab its share of the subscription economy for digital media.

Television stations are also seeing success in the digital realm. Local Chicago station WGN has invested heavily in their viewers being able to stream its news programs anytime, anywhere and were rewarded with a 370% increase in web-site traffic in the two years since the channel began streaming videos.

Magazines like Newsweek, The Sporting News and SPIN magazine have all bet against print by switching to an online-only publication model with advertising and subscription fees for the full article.

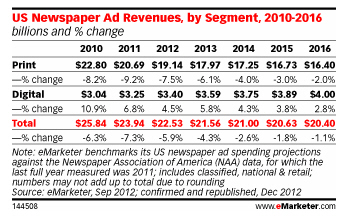

As the chart above indicates, US newspaper ad revenues for print are expected to decrease in the coming years, while digital ad revenues steadily increase. Newspapers like the Chicago Tribune and Chicago Sun-Times are offering a freemium model which requires registration to read certain articles.

They also offer add-ons for registered customers. This practice is heading in the direction of upselling additional services to loyal customers, as the Tribune does with its digitalPLUS membership offer. Of course, paywalls do more than generate revenue. They also gathering info about users that can be used for later retargeting efforts.

As a caveat, the situation is not as one-sided as it seems. The Daily was an online paper and also the brainchild of Rupert Murdoch and Steve Jobs. With big backers and a compelling subscription price, this news medium was an utter flop and shut down two years after it opened.

Nevertheless, we will continue to see companies outside the traditional media disrupt and dislodge offline competitors who are slow to adapt to the digital revolution.

Cracks In The App-Store Business Model

Riding on the coattails of the digital revolution is the App Store Dream. According to Vinnie Mirchandani, “Apple says it has written $6.5 billion in royalty checks to iOS apps developers in the last few years.”

But don’t quit your day job to write apps just yet. According to the New York Times, app makers like “Shawn and Stephanie Grimes’s efforts have cost $200,000 in lost income and savings, but their apps have earned less than $5,000 this year. ”

Now that smartphone penetration has reached grandma and people have their core apps downloaded to their phones, businesses will realize that the App Store Dream is a fallacy and we will see more companies break free of the app store chains of 30% commission and lack of product visibility. Anyone that thought that Google, Apple or Microsoft would help you market your product were lulled into a false sense of hope. You always have to do your own marketing to be successful.

Rise of offline subscription payments in online service companies

The days when you could only offer credit cards as a subscription payment method are numbered. Customers around the world have their favorite way to pay, whether it’s Konbini in Japan, wire transfer in Germany, iDeal in the Netherlands or Boleto Bancario in Brazil.

Companies will need to face this reality and the business process changes that result from providing customers their preferred payment options. At this point, companies will also need to measure success by their churn rates which becomes as important as conversion rates in a subscription business.

LinkedIn Ecommerce

Two years ago on this blog, we predicted that LinkedIn will begin offering a store concept within the LinkedIn company section. Of course, that has yet to happen.

LinkedIn has not started selling retail through e-stores but that doesn’t mean they aren’t making money. SaaS product monetization is quite complicated, but there are several different ways to find success. Amazon provides one example. Primarily, they created a marketplace of retail products, but they also sell B2B products and services as well. In LinkedIn’s case, it prioritizes sales of its lucrative recruiting tool, which goes for over $8,000 a seat.

Here’s the secret about social media. Social networks are giant spaces filled with eyeballs – but not they’re that useful for making money. Or are they?

On the one hand, social networks are large pools of people with money. On the other hand, they are notoriously poor performers in terms of click-thru-rates and conversions on transactions. Social networks themselves will continue to struggle in monetization efforts, but businesses will continue to adopt more social features to engage customers at all touchpoints from SEO to prospecting to selling to customer service.

Here is to a prosperous year full of optimization and engagement. Cheers!

Pingback: E-Commerce Predictions for 2013 | EvolvingSites Blog

Thanks for sharing the insights.

Yes Linked in and other such sources has definitely become a hub for the recruiters and business