Whether you’ve gone full subscription or just considered it, you need to assess whether you have all the tools your need to grow your online revenue.

With an array of options, it can be easy to get locked into a provider that doesn’t meet your company’s specific requirements. Or, even worse, the wrong solution becomes a limiting factor in responding to future shifts in products/services, pricing or market opportunities.

Depending on your current infrastructure and in-house expertise, you’ll have to decide between building or buying a solution to handle payments, subscription management and other miscellaneous ecommerce capabilities.

Building a solution on your own takes a lot of planning, development and maintenance. So when you choose to implement a commerce solution, you’ll be looking at three main categories of providers:

- Billing / payment solutions

- Subscription management solutions

- Full-service solutions

We will explore the first category in this post, and then we will follow up with our analysis of the other two types of commerce solutions in future posts.

Category: Billing / Payments Tools

A payment gateway provides the technology to securely capture and transfer credit card information from a website shopping cart to the merchant account. A merchant account handles the financial processing of the credit card transaction with the banks and card brand (VISA, MasterCard, etc.). It is very typical to have one company supply the merchant account and another supply the payment gateway because very few companies supply both services under the same roof. Some payment gateways have even evolved to offer simple recurring billing features.

Use Case

This solution can be the best option for small businesses and startups that don’t have the volume to obtain a merchant account or for companies with largely physical goods looking to experiment with digital business models. If you’re doing simple plan-based billing, then you’ll be pleasantly surprised at how quick and easy it can be to configure one of these gateways to do just that.

Many payment and billing platforms have been fine-tuned over decades to support the core commerce management of one-time purchases of physical goods.

Some of them have even evolved and launched simple recurring billing modules on top of their payment gateways. This solution can be the best option for small businesses and startups that don’t have the volume to obtain a merchant account or have simple subscription needs, or for a company largely selling physical goods looking to experiment with simple digital business models.

Unfortunately, the management of subscriptions can be quite complex in the digital world. Subscription models used by companies like Salesforce offer customers different levels of functionality for a variety of prices per seat, per month.

Scheduled flat fees might not be too complicated to calculate, but what happens when a customer adds or cancels seats in the middle of the billing period and prices need to be prorated for partial months? Or the credit card on file expires and renewal billings fail? What’s the tax rate on that service? Can you track each plan’s churn rate?

Moreover, usage-based subscriptions require billing unique amounts with each renewal, which requires a system to calculate usage.

Subscriptions also require advance customer notifications in order to reduce churn and keep cash flowing. As you can probably imagine, the complexity of managing subscription information for thousands – or even millions – of customers increases exponentially.

In these cases, a payment or billing platform falls short.

Because many of these solutions were born out of the one-time purchase world, they can lack the specific or robust subscription capabilities to support business models built around digital goods or services. If you’re not looking to develop those capabilities in-house, the next two solution offerings might be a better fit.

Keystone

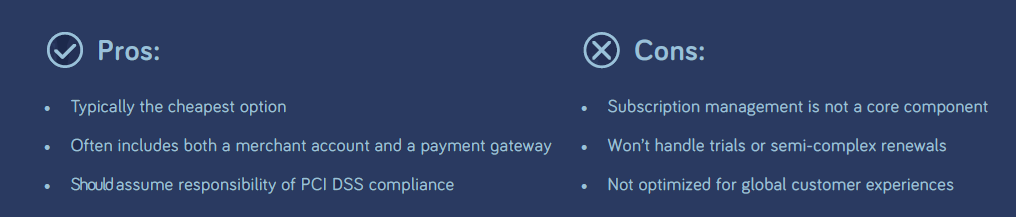

A billing/payment solution can be the best option for companies of all sizes with simple digital business models as it’s the cheapest option to get you started with accepting basic recurring payments. However, if you’re going to offer a complex or high volume subscription product which requires robust subscription and recurring revenue capabilities, you will be better served with one of the two following options.

For a sneak peek at the other two types, check out Navigating the Solutions Landscape.

Ryan Greives is the Public Relations Manager at cleverbridge.