The advent of ecommerce brought global selling to the masses. Buyers across the globe can now easily find your products thanks to online selling. Although ecommerce removed many barriers to global selling, new challenges have appeared. One of the most important topics to consider is how to price your products to make sure you are presenting each country’s taxes in a way that is customary to the local buyer.

Tax prices are presented in a variety of different ways depending on which country buyers are from. And you must present the taxes in the way buyers are used to seeing them, so as not to raise suspicion and risk abandonment.

Customers want to make sure they are buying from a legitimate source. Presenting taxes incorrectly raises a red flag in their minds. Think about it, would you purchase a product from a site that displayed your local tax in a way you have never seen before?

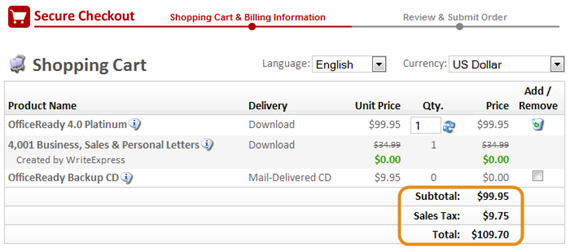

In the U.S., sales tax is added onto the marketed price. Customers who go to a brick-and-mortar store are used to seeing a price of $99 knowing they will pay more than that for the product. In Illinois, the sales tax is 9.75 percent, which means that the tax on a $99 product is $9.65. So, on a website, the product would be advertised for a price of $99. However, once the U.S. customer enters the shopping cart, the tax is displayed and added to the price. This is how U.S. customers are used to seeing prices, so this is how they expect it will be displayed in the cart.

In the U.S., sales tax is set at the state, county and city levels, so the rate varies widely across the country and within individual states. For example, the sales tax in the state of Indiana, which shares a border with Illinois, is between 8 percent and 9 percent.

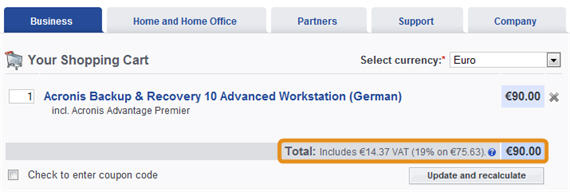

In the European Union, however, Value Added Tax (VAT) is a tax on the perceived value of a product and is marketed as a component of the final price. Customers who see an advertised price of €99 will pay exactly 99€ at the register. Often times, an additional note on the marketed price indicates how much of that marketed price is actually the VAT.

For example, a €99 product for sale in Germany appears with a disclaimer that €19 of that amount is due to the 19 percent VAT in Germany. EU VAT varies by country. For example, the UK VAT is set at 17.5 percent, Germany at 19 percent and Denmark at 25 percent. There are a few exceptions to these flat, country wide rates for restaurants and food, but these are accurate for most products.

Keystone

As you can see, it’s important to be aware of not only what the tax rate is for a country when selling globally, but also how to present it to customers. Make sure your ecommerce store supports these small details; they make a huge difference in abandonment rates.

Great article! I never thought of that.

What do you suggest that a website that sells to both EU and US do about the advertised price? Should we display different prices? Wouldn’t that look more suspicious to the customers if they find out?

Thanks Ammar!

How to handle the advertised price between both the US and EU (or other regions for that matter) is a complex question that we will handle in a future post. However, in the meantime, I recommend that you look at how your price compares to the competition to see immediately if you are priced to high or low outside your home market. That will give you a clue if you have an urgent issue or not.

cheers,

craig.