Online Taxation Changes: Fair or Balanced?

Death and taxes may be the only two certainties in life, but blink and the rules around sales tax change before you realize it. Selling software online has been a more or less tax free activity since online commerce began in the mid-90s, but change is afoot around the world. Know what’s happening to avoid an ugly surprise later!

US Internet Sales Tax

In 1967, the Supreme Court of the United States ruled that state governments may only collect sales tax from businesses with a physical presence in that state, thus paving the way for the current state of ecommerce, where consumers typically order products tax free. Online shoppers pay sales tax when the seller has a tax nexus in the buyer’s state.

For those unfamiliar with the SCOTUS case, a tax nexus is created when the seller and buyer are located in the same state. When a tax nexus is created, the buyer must collect and remit sales tax to the state.

Now, the federal government is considering lifting the moratorium on Internet sales so that states can collect Internet sales tax from sellers even if the seller is not in the same state as the buyer.

Why is the status quo changing?

The removal of anywhere from 5 to 10 percent for sales tax was a boon for ecommerce, but a thorn in the side of brick-and-mortar business everywhere because they believed they were at a competitive disadvantage.

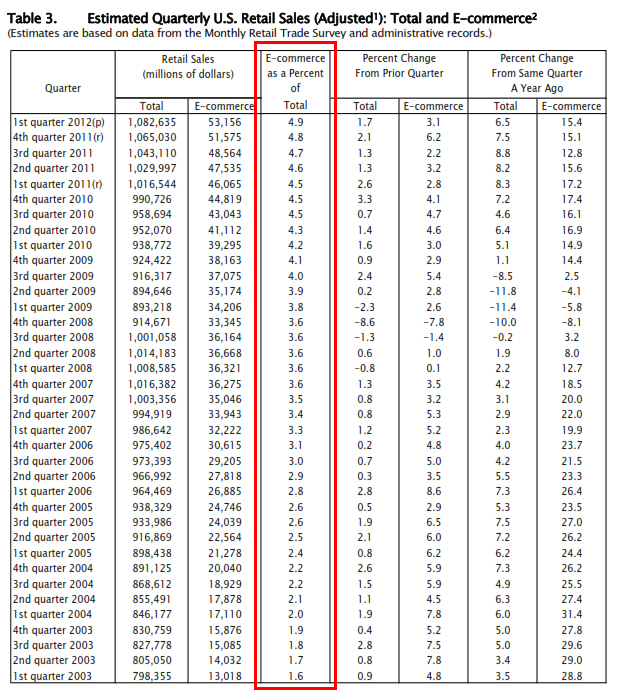

However, when the economy deteriorated in the late 2000’s and budget holes became big enough to drive an armored truck through, state governments began to look for ways to increase tax revenues. At this point in time, ecommerce had grown to be a meaningful percentage of total retail (almost five percent and growth is expected; see fig. 1).

Furthermore, the brick-and-mortar businesses competing with online business were upset by their perception that customers willfully shop online to avoid sales taxes (never mind that studies have dispelled this myth).

Thus, a weakening overall economy combined with a strong ecommerce economy led to a political marriage of Democrats and Republicans pushing for legislation that obligates companies to pay sales tax and generates more income for the states.

When (not if) this happens, online stores may be required to collect and remit taxes for up to 50 different states regardless of where the company is based. Their options are either cultivating an in-house tax department or integrating their e-store with solutions like Avalara or Vertex which automate sales tax collection and remittance.

Electronic Software Delivery

Companies that sell digital products like software, SaaS and subscriptions, have been dealing with online sales tax for some time. Much like Amazon having a sales tax nexus in any state where they have a physical presence, states have been looking at online companies that use affiliates and interpreting or passing laws that make affiliates the equivalent of in-state presences.

Therefore, software companies may be obligated for collecting Internet sales when states establish that a tax nexus is created when affiliates with websites in one state link to the websites of out of state businesses. Laws have been changing for some time now, and software companies have been forced to either drop their affiliates in certain states or start collecting sales tax.

International Alternatives

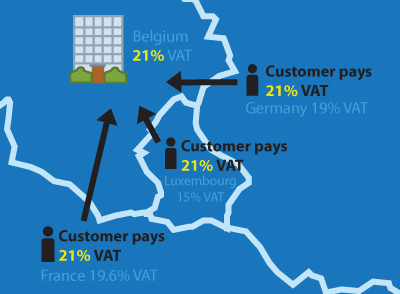

Unlike the U.S., the EU has been collecting value added tax (VAT) for digital products since 2003, regardless of the buyer or seller’s country. Also, unlike most U.S. states, the EU tax rate depends on the origin of the product, not the destination. That means that if the seller is located in Belgium and the buyer is located in Germany, the Belgian business must collect sales tax from the German consumer at the Belgian VAT rate, not the German VAT rate (Fig. 2).

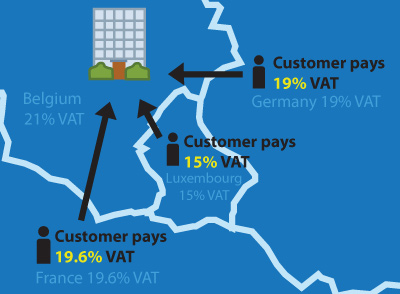

However, a destination based model resulted in companies opening shell-offices in an EU member state with a lower VAT rate, even if most of their business is done in a country with a higher VAT rate, and thereby maintaining a price advantage over other companies. Because of this issue, the EU will be switching from an origin based sales tax collection to a destination based one by 2015 (Fig. 3).

Solutions

Because of the number of taxing jurisdictions around the globe, complying with all tax requirements on your own is likely to be time and cost prohibitive.

Up until this point, we have focused on the US which has roughly 7500 separate jurisdictions administering sales tax. The EU is obviously complex as well. Factor in other countries like Korea or Japan or Brazil and you see that trying to comply with every tax law in world quickly distracts from the business of building great products and bringing them to market.

Whether you rely on a third party or your own tax adviser, collecting and remitting online sales tax is a complicated issue that requires patience, diligence, time and money.

Keystone

Unless you’re a large organization, consider partnering with automated tax solutions or an ecommerce provider in order to avoid large tax bills in your future.

You did a great job of highlighting the major forces driving additional complexity around calculating, collecting and remitting taxes (sales, VAT) to the authorities in the USA, Europe and elsewhere.

Based on the growing size of online sales, poor fiscal condition of state, local, and federal / national governments, and legislative climate, it’s clear that e-commerce is a juicy target for tax authorities and it’s not going to make sense for most online merchants to do deal with these issues on their own.

I agree with Doug that e-commerce is ripe for the plucking and sales tax is the low hanging fruit. The process of legislating the situations in which the tax is collected, and who collects from whom, is going to be like wrestling an alligator. I recently learned about the Streamlined Sales Tax Project, which, according to Wikipedia, “arose in response to efforts by Congress to permanently prohibit states from collecting sales taxes on online commerce.” Here’s a worthwhile intro to the SSTP: http://www.nolo.com/legal-encyclopedia/sales-tax-internet-29919.html