Digital product ecommerce is a special breed of ecommerce because of the expectation of instantaneous product delivery. Because the product is digital, today’s buyers rightfully expect to receive it immediately upon completion of the purchasing process.

However, many customers prefer to pay for products via payment methods that require an offline step, such as Konbini, Boleto Bancario, wire transfers and even PayPal. Don’t lose sales because you aren’t aware of these offline payment methods, which require special handling in your ecommerce system.

With offline payments, a customer places an order for a product online, but completes the payment at a later time and through a different interface. For example, the Japanese Konbini payment method requires the customer to print out a transaction receipt, take it to the local convenience store and pay the cashier for the product.

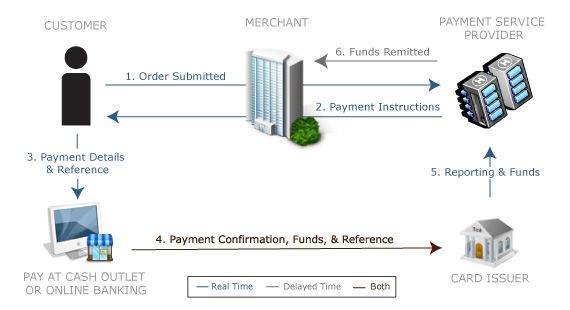

The Konbini system notifies the merchant that a successful payment has arrived, and only then is the order fulfilled. This entire process can be completed in as little as 15 minutes, or take days or even weeks, depending on the obstacles presented to the customer from the time that the order is placed until the payment is made. The graphic below describes the different steps required to complete an offline payment.

In real life, any time an offline payment order is submitted, there will be a significant percentage of orders that are never paid. This is a fact of life because some buyers experience remorse after placing the order, realize they have insufficient funds or have an honest memory loss about the order. The hard truth is that the majority of these orders will remain unpaid.

However, there are ways to recapture some of these “lost” orders, and more importantly there are huge advantages to offering offline payment methods like Konbini, Boleto Bancario, wire transfers and PayPal.

ADVANTAGES OF OFFLINE PAYMENT METHODS

Unlike credit cards, where a customer can simply call their bank and rescind the payment through the chargeback process, when money arrives for an offline payment, there’s often no opportunity to automatically rescind the payment. Rather than having to keep a reserve of money for up to six months to cover credit card chargebacks, money received by offline payment can typically be used immediately.

Another advantage for offline payments is that there’s frequently less private information stored to attract hackers. In the case of PayPal, the only personal information stored is a customer’s email address, which is captured during the order process any way.

PayPal’s website is an attractive target in this case. But even though fraud caused by stolen account credentials can be a problem with PayPal, you usually know about any fraudulent orders within two to three days because emails are sent to the account holder following any payment activity.

DISADVANTAGES OF OFFLINE PAYMENT METHODS

It’s extremely important to ensure proper processes are in place to prevent products from being delivered to the customer before the payment is cleared. If your process functions like a credit card transaction, where the order submission triggers delivery of the product, lost sales will result because customers receive the product before payment is made. The graphic below shows the proper location for your fraud screening capabilities in the order process.

Costs for offline payment methods vary widely– from virtually free (when automation is possible) to 25%+ of the transaction amount! However, even if the cost is significant, any additional sales will most likely offset these costs because, as pointed out in a recent post, customers are more likely to purchase when they have their preferred payment methods and currencies available.

Keystone

: Offline payments may be more complex to support than credit cards, but you should consider the advantages of offline payments when deciding whether or not to support them.

Do you have any fears about supporting offline payments from other countries? Which countries are the most frequent users of offline payments?

E-commerce in general should be looked at from the perspective of the client base. Too often e-commerce software sales are geared towards the usability and impulse purchasing habits of the individual consumer… The reason for this is that in end-user sales the customer (one who pays for product) and the consumer (one who uses the product) are the same.

I agree that that all consumer sales should be processed immediately via a secure e-commerce provider that can deliver instant customer gratification and delivery…

However, anytime you get into any B2B or commercial sales; the wants and needs of the customer and consumer are completely different. We need to focus on the customer – who is not necessarily the consumer of the product. This is usually the purchasing agent or IT director. As we know it, they have complex purchasing processes that can not be circumvented. In most cases these clients needs vendor quotations, sole-source letters etc. along with payment terms.

I disagree that all offline payment orders are never paid or customers experience remorse or memory losses about the order… I think that this maybe true for individual consumer sales; but definatly is not the case for commercial and educational sales – which amount to 80% of our business. We have never had a delinquent purchaser through our offline payment methods.

BTW. I don`t mean to ruffle any feathers on my first post. I think that this is a great blog!

Hi Lyle,

Thanks for the post and don’t worry, we don’t mind some ruffled feathers!

I think that you make a good point that the target of the offline orders noted in this post are targeted towards B2C and B2B is a much different beast. For B2B, many more orders than B2C offline do get paid because those B2B customers generally need the product and the money isn’t their own. Hence, the barriers from indicating interest (submitting order) to completing purchase are much lower with B2B.

Nonetheless, you bring up a great idea for a future blog post. Thanks for interacting!

craig.

Thanks Craig,

You’re right B2B is a completely different beast. I usually tag offline sales to B2B and expect all consumers to pay online by credit card. We try not to accept any offline payments from end-users.

The client event in San Francisco was very educational and fun.

This is a thoughtful and well done blog.

We have always tried to make it easy for customers to send offline payments, purchase orders. While it would ideally be outsourced to a vendor — these orders seem destined to be fulfilled by the vendor directly — in this way, customers will likely get better personalized service, more generous terms when risk is considered and better follow-up for payment.

We have received everything from Money transfers to personal checks to money orders — have yet to receive an offer of chickens for software!

Hi Jim,

Thanks for the comment. Anytime that you can have a one-on-one relationship with the vendor, it certainly will help in terms of loyalty, word of mouth and ultimately sales. As organizations scale up in size, this can become a challenge, especially when thinking internationally. B2B orders are definitely a different breed than B2C and we’ll investigate this in a future post.

What would you do if you did get a barter offer? Has it happened yet? I know that this is done fairly frequently in the service sector.

craig.