In Europe, just as in the US, affiliates are an important channel for increasing revenue because consumers often turn toward download portals and review sites like Chip (Germany), 01net (France) and PC Advisor (UK) before buying software products.

If you are a US-based software publisher looking to expand into new markets, or you have already ventured into the European affiliate market but haven’t found the secret recipe for success, this post will guide you through the initial steps of researching your target market.

Factor #1: Targeting Your Market

How do you decide which European markets to target? Many software vendors find that the UK is a good place to start because the shared language with the US means that existing products, marketing content and collateral can be leveraged effectively. However, you’ll be missing opportunities in other lucrative markets.

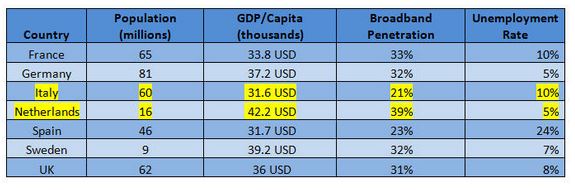

To make a sound decision, research various markets in Europe and create a comparative chart. This chart should include data like population size, per capita GDP, broadband penetration rate and even unemployment rate in each country. If you can, try to find data on consumer spending habits for your type of software product.

Limiting Table 1 to population, you might have thought Italy is the better target for your affiliate activity. By including GDP per capita, broadband penetration and unemployment rate you see that Netherlands has over 25% more earning power and almost 200% the amount of broadband capabilities as Italy with half the unemployment rate.

While Netherlands has a smaller population, it has a better infrastructure to support a successful ecommerce market. Based on this information, you find an easier market in which to sell software.

Factor #2: Research Your Competition

Aside from market research, you have to know if your product sells successfully in your target market. With the help of Google, Alexa and SpyFu you can discover where your competitors are operating in Europe and where they are seeing success.

For example, if you sell antivirus software you may want to see which German sites are advertising that type of software. All you need to do is go to Google.de and search “antivirus download.” Your results page will, of course, display company sites like Avira, Avast and Norton, but you will also see results for download portals like Chip.de and Computerbild.

Now you can check to see if these networks carry any weight in the market by investigating their Alexa rank, which measures website traffic and provides information on a site’s traffic sources. Both Chip and Computerbild have excellent Alexa rankings so these are sites you want advertising your product.

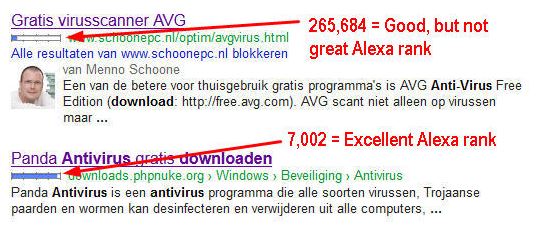

Use a similar process to find attractive affiliates in Holland. As a smaller market, this process is a bit more complicated and yields interesting results, but the techniques apply across all markets.

First, open Google Translate. Find out the Dutch translation for ‘antivirus download’ (antivirus downloaden) and search that term at Google.nl. On the first page of results you will notice two different affiliates, SchoonePC and PHPnuke.

Despite, SchoonePC’s higher organic ranking for the search term, its Alexa rank (265,684 ) is not as excellent as PHPnuke’s Alexa rank (7,002).

Prior to the investigation, there was no way to know where to advertise your program to the Dutch. With a little research, you now have several options and you know which one is likely to bring more traffic. Right?

Wrong.

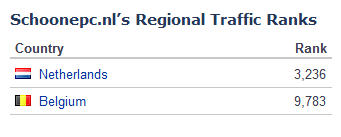

Although PHPnuke has a very good Alexa ranking, by drilling down into the regional traffic sources provided by Alexa, you see that PHPnuke’s popularity has little to do with your target audience.

Out of the top ten most popular traffic sources for this site, not one is European. Granted that PHPnuke is popular in some European countries farther down the list, but you want to partner with an affiliate who is as focused on your target audience as you are.

SchoonePC, on the other hand, is laser focused on a Dutch audience, despite a relatively high Alexa ranking worldwide.

The amount of focus affiliates place on your target audience is an important consideration when choosing with whom to partner.

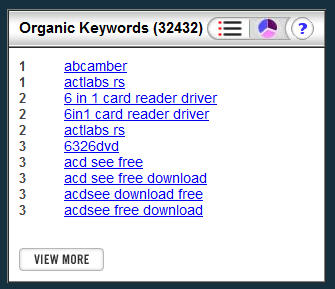

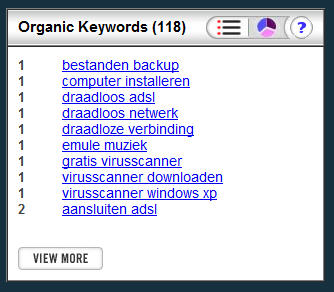

Another consideration is which keywords are bringing traffic to this site. You can find this information using SpyFu, a search analytics company. The keywords driving traffic to PHPnuke might be great for companies selling drivers and photo editing software, but it is not focused on your target audience if you are looking to advertise antivirus software to a Dutch audience.

On the other hand, the keywords driving traffic to SchoonePC’s site reflects a Dutch speaking audience looking for antivirus software.

Based on these considerations, as a seller of antivirus software looking to advertise in the Netherlands, a country you know to possess a higher amount of disposable income relative to its neighbors, you should choose the smaller, but focused affiliate rather than the larger, more diffused affiliate.

The important thing is to research each country individually. If you only speak English, use Google tools like Translate and the Chrome browser to translate for you. Of course, a native speaker is always best if you have the resources.

Factor #3: Internal Investigation

In addition to your market comparison charts and affiliate research, look at your customer order records and analytics information. Find out where visitors are typically coming from and see if you’ve received orders from a particular country. Maybe your product has been selling well in some foreign market and you didn’t notice.

To find the right affiliates it’s important to have as broad a view as possible of who is looking for your software. If Table 2 is a snapshot of your daily European traffic, you see that a larger percentage of Netherlands’ population is coming to your site than the percentage of Italy’s population.

Table 2

Even if you have not served many customers overseas, there may be a history of European customers, resellers or affiliates who have inquired about the availability of your software products in other European languages and markets. Ask yourself, “Has there been a pattern of requests that identify an under-served market?” Speaking to your sales team and customer reps might reveal valuable information that points in the right direction.

Keystone

Market research, competitor review, and internal investigation are three building blocks on which to base the decision for what European affiliates to partner with.

Stay tuned for more information on the European affiliate market where we discuss localization concerns, affiliate networks, and “super-affiliates”.

Werner Decker contributed to this blog post