This month we focused on trends in mobile apps, the Asian ecommerce market, customer service KPIs and the ever controversial “death” of software.

We’ll continue these topics in our ecommerce digest, with more information on mobile trends and customer service KPIs from Parature. We’ll also delve into the online sales tax discussion as tax-free Internet shopping comes to a close.

How Bad Is the PC Market? Analysts Count the Ways | AllThingsD – Our ears all perked up recently when we heard that PC sales suffered from their worst market contraction ever. Yes, the PC market is down. But does this mean that on-premise software is going the way of the LaserDisc?

Not quite. Even though PC sales have slowed, people are not throwing away their computer towers and laptops. These are still important devices for businesses and consumers. We will continue to use keyboards and mice and discs for many years.

However, it is important to see where the market is heading. Software applications of every type will need to update their offering. This is done through testing and iteration, the ability to deliver complex functionality, display it simply, access it conveniently, and integrate it socially. Certainly, cloud and mobile technology are expanding our understanding of the how and where of personal computing, but they haven’t quite replaced the PC and its software.

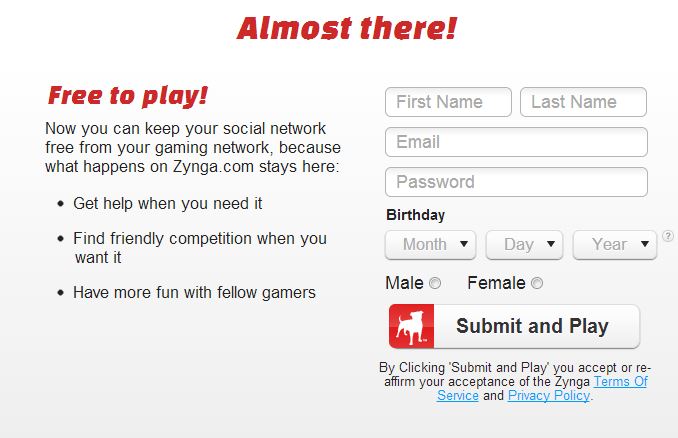

Zynga.com ditches mandatory Facebook logins as it struggles to create its own identity | The Verge – Another cautionary tale in the danger of codependency. Relationships both nurture and smother those involved. In this case, Zynga, which used to depend on Facebook for its user base, is striking out on its own after once contributing 19 percent of Facebook’s revenue.

With mobile usage exploding, perhaps it was silly for Zynga to leave it’s rich uncle Facebook. But Zynga’s already locked into the Google Play and App Store ecosystems. Why lock itself into a third ecosystem when it can offer users more on it’s own? Let’s just hope they keep the social login process simple.

FCR: Hitting a Home Run for Your Customer Service Team | Parature – All good customer service departments monitor KPIs like contacts per day, hold times and response times. But how many contact centers measure first contact resolutions? The best customer service operations resolve the vast majority of their inquiries on the first contact. But most companies achieve first contact resolution rates of only 56 to 46 percent.

Training customer service representatives is one way to improve resolution rates. CSRs should be adept at resolving common issues and escalation procedures. Another way is to optimize self-service tools on your website, like FAQs or video content. These should answer common questions customers have regarding their purchase, whether it’s a billing question or a technical question. Either way is an investment in customer retention.

Yes, It’s Time for an Internet Sales Tax | The Atlantic – Last summer we wrote that the federal government would soon allow states to tax Internet shopping. With the imminent passing of the Marketplace Fairness Act, the clock is winding down on tax-free remote selling.

The language of the bill indicates that this will be a destination-based tax: If a software company in Illinois sells and delivers a product to a customer in New York, the company collects a tax from the New York resident and remits it to the state of New York. It’s no longer just about sharing a nexus with your customer. You create a nexus in another state by selling your product to one of its residents.

Reading the bill, I had a few questions: How often will businesses have to remit these taxes to far away governments? As often as the local companies. Will all goods be subject to local sales taxes? That’s for each state to decide on its own.

There’s been a lot of jeremiads about how the Marketplace Fairness Act will burden businesses with responsibility to remit taxes to between 46 and 9,646 different tax jurisdictions. The language of the bill indicates that this won’t be too much of a hardship. It has provisions for states to streamline the collection amounts and the remittance process. Small sellers can rejoice as they have an advantage over the big sellers. Companies that sell under $1 million in online revenue are exempted from collecting the tax.