As independent software vendors you know that online buyers from across the globe might land in their e-stores, and you’ve probably considered if and how you can generate revenue from the Asia-Pacific (APAC) market. After all, Asian ecommerce market is the center-of-gravity from a population standpoint. Out of a global population of seven billion, roughly half live in Asia, with China and India alone contributing about 30 percent of the entire global population.

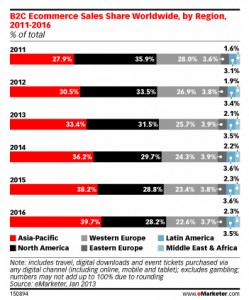

The APAC region is rapidly becoming an important economic center as well. According to eMarketer, it will be responsible for a larger share of B2C ecommerce than either North America or Europe in 2013. As far as the IT market is concerned, Forrester estimates that $104 billion are spent on software in APAC with Japan generating the lion’s share of those sales.

Since the APAC region hosts such a large group of online shoppers, you’ve invariably wanted to maximize your online presence there. The problem is that Asia is not a homogeneous place. Localization for your site cannot be one-size-fits-all, but must accommodate a variety of languages and payment methods used in different regions throughout the continent.

Asian Ecommerce Market Sizes

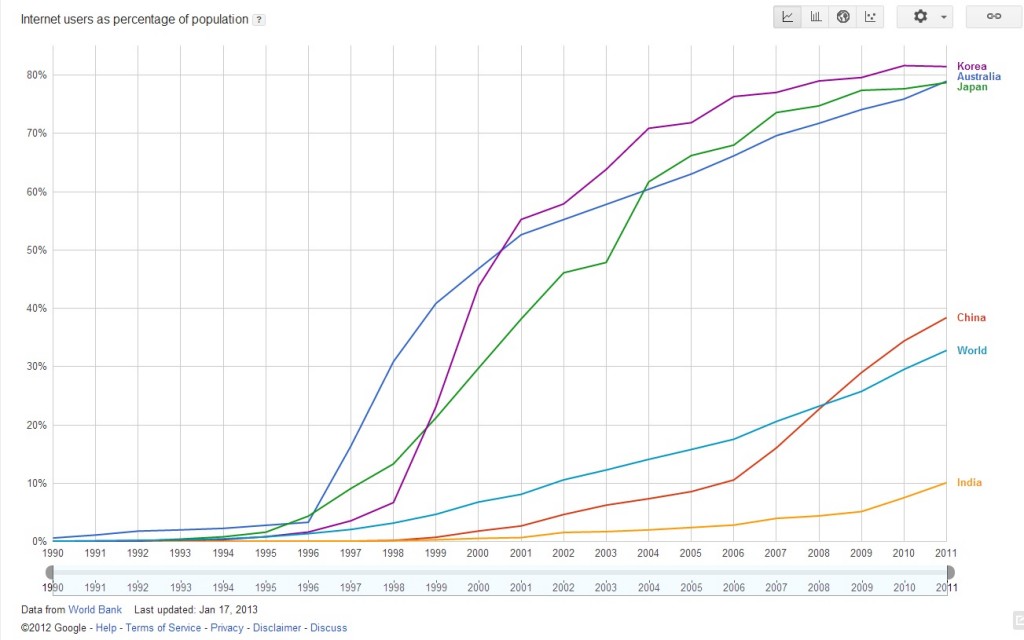

In his observations of the network economy, Kevin Kelly notes that each new node in a network increases its value exponentially. When determining the potential value of a an ecommerce market, and whether it is worth localizing for, we start by noting how many Internet users a country has, especially as a percentage of that population.

The graph below indicates that a large percentage of the population in Korea, Australia and Japan use the Internet. The percentage of Chinese and Indian citizens is much less than those mature markets. However, the overall amount of users in China and India is greater than Korea Australia and Japan. The graph also does not indicate the growing nature of the Chinese and Indian markets, and the vast potential they contain.

Let’s take a closer look at these countries, which together account for $400 billion or nearly 81% of the APAC ecommerce market.

South Korea

- Is a strong, mature market with a per capita GDP of $32,000

- Had software sales of $5 billion in 2012

- The population is 50 million people

- Challenges include SaaS adoption, which is slowly progressing and is in the planning & implementation stages

India

- Is a young, growing market with a per capita GDP of $3,900

- India has vast potential as an emerging ecommerce market

- Software sales in 2012 were $5 billion

- The population is 1.2 billion people

- 9% have broadband Internet access (80M users)

- Challenges include pricing products for a weak currency and the piracy issues that result from not being able to afford software

Australia

- GDP per capita is $42,400

- Australia is a mature market whose growth is slowing, but most users have made purchases online

- Software sales in 2012 were $10 billion

- Population of 23 million people

- 90% have internet access (19M users)

- Highest SaaS/cloud adoption in APAC; 36% of organizations use cloud-based services, up from 22% in 2010

- Challenges include the size of the market, which is relatively small and mature, with little room to grow

China

- GDP per capita is $9,100

- 1.4 billion population

- Software sales were $15 billion in 2012

- 34% or 513M users have internet access

- SaaS adoption is slow; has large potential to grow for basic business applications

- Challenges include pricing, piracy, and a small middle class. Chinese consumers don’t use credit cards as much as third party payment methods like Alipay

Japan

- China is the ecommerce king of tomorrow; Japan is today

- GDP per capita of $36,200

- Software sales in 2012 were $54 billion, which is roughly half of all other APAC countries combined

- SaaS adoption is growing faster than all other APAC tech markets combined

- Population of 128 million people

- Online marketplaces dominate

Complexities to Consider for all countries:

- Localization (language, web design, currency, payments)

- Customer support

- Quality assurance

- Pricing & channel strategies

When thinking about how to penetrate these markets, you’ll need to consider several go-to-market models. We’ll be elaborating on these models in future posts. For now, your options are:

- Direct via ecommerce

- Direct via ecommerce Managed Services

- Indirect via Publisher or VAR(s)

- Sell via Joint Venture (JV)

- Sell via wholly-owned local entity

- Hybrid of the above

Keystone

You may think Asia is all the same, but it is not. It’s a basket of many markets and different stages of maturity. Heterogeneity exists not only in terms of languages, but also in terms of online market maturity, ecommerce buying culture, and purchasing power parity (GDP per capita). Nevertheless, there are multiple ways to successfully go to market in each of these different APAC countries regardless of their market’s state of maturity.

Doug Caviness and Ryan Sumner contributed to this blog post

Pingback: The Asian E-commerce Market | Gallery.Clipapic