It was an exciting month with lots of news stories. While millions around the world were following the UEFA Euro 2012, over 800 affiliates from across the globe gathered for the a4uexpo in Barcelona . If you missed it, don’t panic, we’ve got great information about the European affiliate market covered here.

Also, millions of Linkedin user passwords were compromised by hackers so we want to reemphasize the importance to software companies of protecting their most important assests: customers.

For now, I leave you with some excellent digital ecommerce articles on SaaS, subscriptions, retargeting and the dreaded internet sales tax.

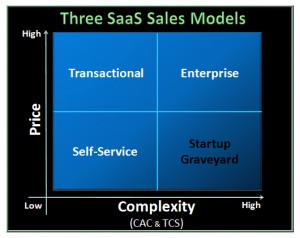

SaaS Startup Strategy | Three SaaS Sales Models: I found this piece rooting around the archives of Joel York’s blog, Chaotic Flow. It’s an in-depth look at three different models for selling SaaS products: customer self service, transactional sales and enterprise sales. York also suggests types of SaaS products that are appropriate for each model.

Following a link to Ecommerce Times in this post, I learned that its a common perception that SaaS companies must first offer free trials to an individual who will then convince the rest of his organization to purchase the product. But this is not the only way to sell SaaS. Alternative models abound!

“Passkey is not only selling a high-priced SaaS solution, it generally makes multiyear deals that can be worth millions of dollars. Even more amazingly, Passkey is able to convince its customers to pay for these multiyear contracts up front. It doesn’t have to worry about the cashflow challenges that plague many SaaS vendors who depend on more periodic payments.”

NYTimes.com | E-Tailer Customization – What’s Convenient and What’s Just Plain Creepy: Quick question for the ecommerce managers in our audience: How many of you use targeted marketing to showcase alternative advertising to different segments of your traffic?

Wow, that’s a lot of you.

Did you realize that you may be freaking out your customers? And yet, as this post explains, companies like Amazon have built their business on the basis of personalized advertising and increasing revenue by seven figure for many companies. There appears to be a fine line between being helpful and being creepy, and software companies must tread carefully. If you’re interested in retargeting tactics, check out Jessie Kleino’s post, Four Strategies for Retargeting PPC Campaigns.

Enterprise Irregulars | The Subscription Model’s Role in the Economy: Denis Pombriant, a CRM analyst, introduces this piece expounding on a crumbling global economy, but continues with important insights into the subscription economy. Suffice to say, he encourages companies to provide customers flexible payment options.

“Employing more subscriptions would function like an economic stimulus to the degree that they would stimulate demand among people who have a little money but not a lot and who can’t pull together the cash needed for an outright purchase”

From cars and phones to plowing services, consumers are buying into subscription payment. This is especially true in the software sector. Adobe used to sell products individually at a relatively high price point. Now, they sell bundles of their products as subscriptions. Potential setbacks for companies revolve around shareholder expectations and price points that decrease the amount of immediate revenue in anticipation of future revenue from loyal customers. For further information on best practices for ensuring recurring revenue, read my post, The Dunning Process in Ecommerce.

Nolo | Sales Tax on the Internet: In 1992, the Supreme Court ruled that mail-order merchants did not need to collect sales taxes for sales in states where they did not have a physical presence. If you sell software online, you’re probably aware of this law. The ability to avoid paying taxes has played an important role in the growth of ecommerce. But states are re-examining their laws because consumers tend to be negligent paying use tax. We are likely to witness an increase in state law regarding sales and use tax responsibility.