In our previous installment on the viability of the global ecommerce market, we advised ecommerce companies to focus primarily on growing sales in their home market. We noted that, at some point, the growth rate for one’s home market slows. When this happens, it is time to start thinking about a strategy for international expansion.

We advised businesses located in G7 countries to begin their international sales strategy with other G7 member states because these are mature ecommerce markets whose populations have higher Internet penetration rates, higher GDP per capita, and stronger ecommerce sales than other emerging markets. In other words, consumers in G7 countries have money to spend, and they like to spend it online.

Once you’ve solidified your position in those mature markets, it is time to think about the BRIC (Brazil, Russia, India and China) countries. The BRICs are countries with massive populations, growing middle classes, and expanding ecommerce markets. They currently don’t generate the same volume of online sales in those G7 countries (except China, but that is another story), but they will soon. Forward thinking ecommerce companies would do well to lay the groundwork now for future expansion in these growth markets.

The key to unlocking ecommerce sales in these countries is localization, which means taking your existing offering and adapting it to meet the expectations of customers in a given location. Specifically, it means adapting the language, price, currency, payment method, etc., of your offering to that of your target market.

For now, let us focus on some unique localization challenges presented by Brazilian ecommerce market.

But First, Why Should You Specifically Care About Brazilian Ecommerce?

When you start investigating the viability of the online market in Brazil, you see that it is ripe for palatable ecommerce opportunities.

- It is home to over 200 million people, making it the fifth most populous country on planet Earth.

- It is currently seventh largest GDP in the world in terms of individual countries.

- Online retail sales in Brazil are expected to double in the next two years.

Localizing For Language

While most Brazilians have a passing familiarity with English from their school days, 99 percent of the population speaks Brazilian Portugese (a distinct dialect from European Portugese). To penetrate the Brazilian ecommerce market from afar, you need to make sure the text on your site is translated professionally by someone with an inside understanding of your specific industry.

Since it is costly and time consuming to translate an entire website from one language to another, you must first prioritize which pages on your site are critical for translation. At the very least, make sure that your checkout process and customer service offerings are localized for your Brazilian customers. This facilitates better conversions and ensures that your Brazilian customers can receive the right kind of support should they need it.

Brazilian Payment Methods

Credit cards are used for the vast majority of online payments in Brazil. But around 30 percent of those cards are issued domestically, and they are only authorized to be used in Brazil. Without a local business entity and merchant account, merchants from outside Brazil are unable to accept orders from many would-be customers. If you don’t have the resources to start a local Brazilian office to partner with local banks, you need to find a partner with the capability to process local orders.

Additionally, another significant portion of online sales depend on a payment method called Boleto Bancario. As we noted in our Payment Trends Across the Globe post, the payment process for Boleto is essentially a cash payment. Customers place their order online and receive a pre-filled bank slip. They can then pay for their purchase with cash at a bank or other authorized processors such as drugstores, supermarkets or post offices. Utilizing this payment method in your checkout process increases your chance of raising revenue from Brazilian customers.

Thirdly, growing sales in Brazil depends on offering customers installment payments. Pervasive in Brazil, installments are regularly offered to customers both offline and online, and are di rigueur in Brazilian commerce. Consider the following example:

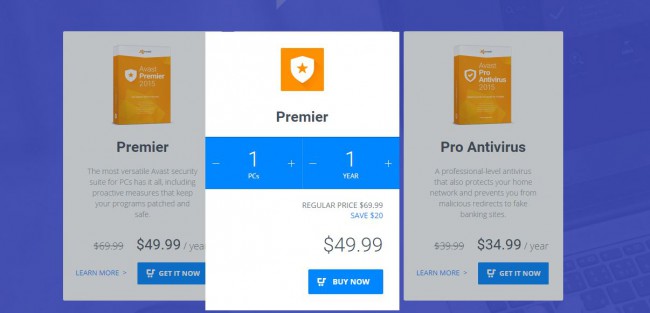

In the Avast U.S. store, their premier product is regularly priced at $70, but is offered here for $50—a $20 savings for a year long license for one PC.

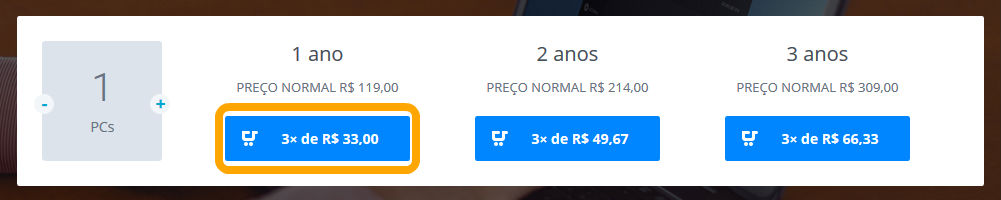

Now consider their Brazilian store for the same product which we found using an IP proxy service to imitate a Brazilian customer’s experience. It is regularly priced at R$119, but offered here for R$99 to be paid over three installments.

Not only does Avast meet their customers’ expectations by offering installments, they wisely reduce the price for the more cost conscious Brazilian customer by over 30 percent. Now, that’s smart marketing. One thing they could do to improve their conversion rates would be to test different localized prices in clean, friendly numbers. $49.67 just doesn’t have the same appeal as $49.99.

Keystone

To effectively penetrate the Brazil market, you will need to understand the intricacies of localization, especially in terms of language, payments and prices.

Brazil is a very interesting upcoming market. This will soon be a very good place to make money.