Online transactions are typically processed without a credit card present at the point of sale. Unfortunately, these types of sales are attractive to fraudsters looking to make purchases with stolen credit cards. The result of online retailers processing too many fraudulent transactions is that their ebusiness will fall like a house of cards. An effective fraud prevention strategy is therefore essential to operating and maintaining a webstore.

This infographic from Chase Paymentech highlights the importance of winning this war against fraud. By investigating the pervasiveness of fraud in ecommerce, we learn that online fraud affects the majority of retailers, which is very costly. These costs emerge in the form of needing to hire anti-fraud employees, a decrease in customer satisfaction, and chargebacks. In fact, the associated costs that result from ecommerce fraud more than double the actual loss from each fraudulent transaction.

Now, one of the great benefits of running a webstore is that orders can be placed by international visitors through a variety of channels. But how many of us are aware that multichannel, international ecommerce is more at-risk for fraud than single channel stores that sell online domestically?

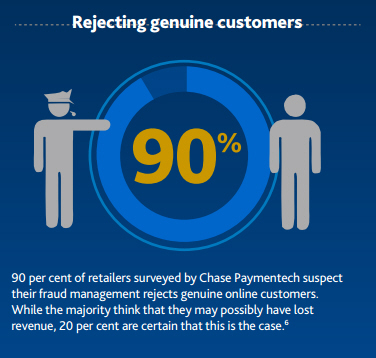

Furthermore, once companies begins screening orders to prevent the fraudulent ones, they also run the risk of blocking valid transactions, thus leading to missed opportunities for revenue.

Ultimately, whether you do your anti-fraud in-house or outsource it, there are many things to consider. But an effective prevention strategy for international fraud increases your bottom line and your customer satisfaction.

Questions? Comments? Let us know what you think in the comment section below.