Credit card fraud is a big problem in stores and online. Now credit card manufacturers are finally making it a bit harder for fraudsters to steal credit card information. Chip-enabled payment technologies developed by Europay, MasterCard and Visa (EMV chip cards) add layers of security against fraud, making cards virtually impossible to duplicate.

This is great news for brick-and-mortar retailers. EMV chip cards come equipped with a security chip, or smart chip, that must be scanned and authorized with each transaction. The chip interacts with the merchant’s point-of-sale device to make sure the payment card, combined with a PIN or signature, is valid and belongs to the person using the card.

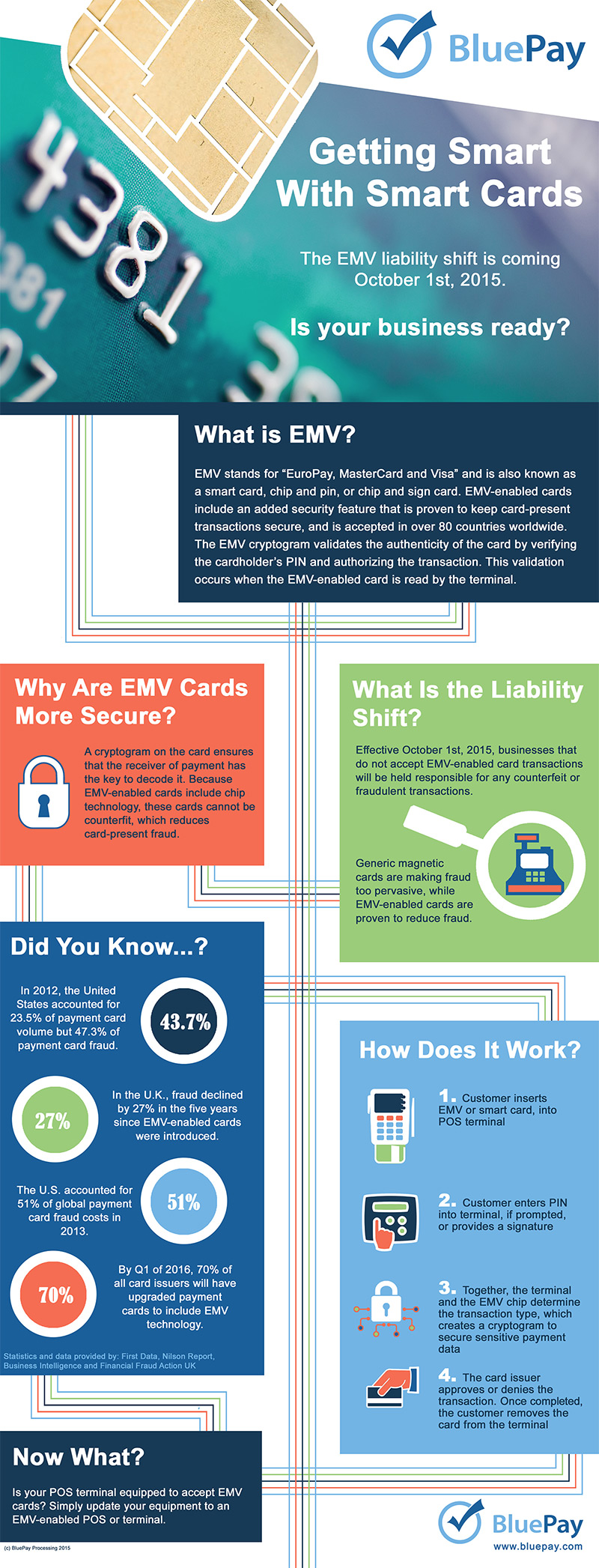

As of October 1, 2015, businesses that do not accept EMV-enabled card transactions are liable for any counterfeit or fraudulent transactions.

This infographic from BluePay provides an overview of how the process works for physical stores.

But what does this mean for online merchants? As we discussed last February, this shift to more secure card-present transactions will have an impact on ecommerce sites. As fraudsters are hindered at brick-and-mortar stores, they will turn their attentions to card-not-present (CNP) transactions online.

During the first 10 years of its transition to EMV chip card technology, the UK saw online fraud increase almost 40 percent.

“Well, if fraud from card-present situations is harder to commit, we can safely assume that fraudsters will move to the online and mobile payment space and try to figure out where there are holes to exploit,” says Tim Russo, Fraud Prevention Team Leader at cleverbridge. “Be as prepared and proactive as possible,” Russo says. “This change is ultimately for the best.”

Leave a comment below about how the shift to EMV cards affects your business, and read more about the value of fraud prevention here.